Five Meetings | | Directors when his or her term expires and when he or she has a change in status, including changes to employment and outside board of directors service, and make appropriate recommendations regarding such matters to the Board of Directors for approval. • Develop and review the Corporation’s Corporate Governance Guidelines and recommend any changes to the Corporate Governance Guidelines for approval by the Board of Directors. • Consider and recommend for approval by the Board of Directors matters pertaining to committees of the Board of Directors, including with respect to structure, member qualifications, composition, committee chairs and committee reporting to the Board of Directors. • Consider and recommend for approval by the Board of Directors the Chairman of the Board of Directors. • Review the Code of Conduct for Non-Employee Directors and the Corporation’s Global Code of Conduct and recommend any changes for approval by the Board of Directors. • Oversee and review with the Board of Directors risk and risk mitigation associated with the Committee’s purpose and areas of responsibility, including Board of Directors’ organization, membership and structure, succession planning, director independence, Board of Directors effectiveness and other corporate governance matters. • Work with the Chairman of the Board of Directors to reviewoversee the evaluation of the performance and effectiveness of the Board of Directors and each committee of the Board of Directors. • Coordinate an annual corporate governance training for the Board of Directors. • Review and oversee the Corporation’s actions on issues related to corporate social responsibility, sustainability, philanthropy, and other matters associated with the Corporation’s participation as a global corporate citizen. Added• Review and oversee the responsibility to reviewCorporation’s political activities and overseecontributions and other public policy issues to ensure alignment with the Corporation’s long-term strategy and values.

The Audit Committee Charter, the Compensation Committee Charter, and the Nominating and Corporate Governance Committee Charter can be found in the Corporate Governance section of the Corporation’s website, http://www.dinebrands.com. Printed copies are also available at no charge upon request to the Secretary at Dine Brands Global, Inc., 450 North Brand Boulevard, Glendale, California 91203,(866) 995-DINE.

| | | 10 | |  |

| 2020 PROXY STATEMENT

| CORPORATE GOVERNANCE

|

| | |  | | 15 |

| 2023 PROXY STATEMENT | CORPORATE GOVERNANCE |

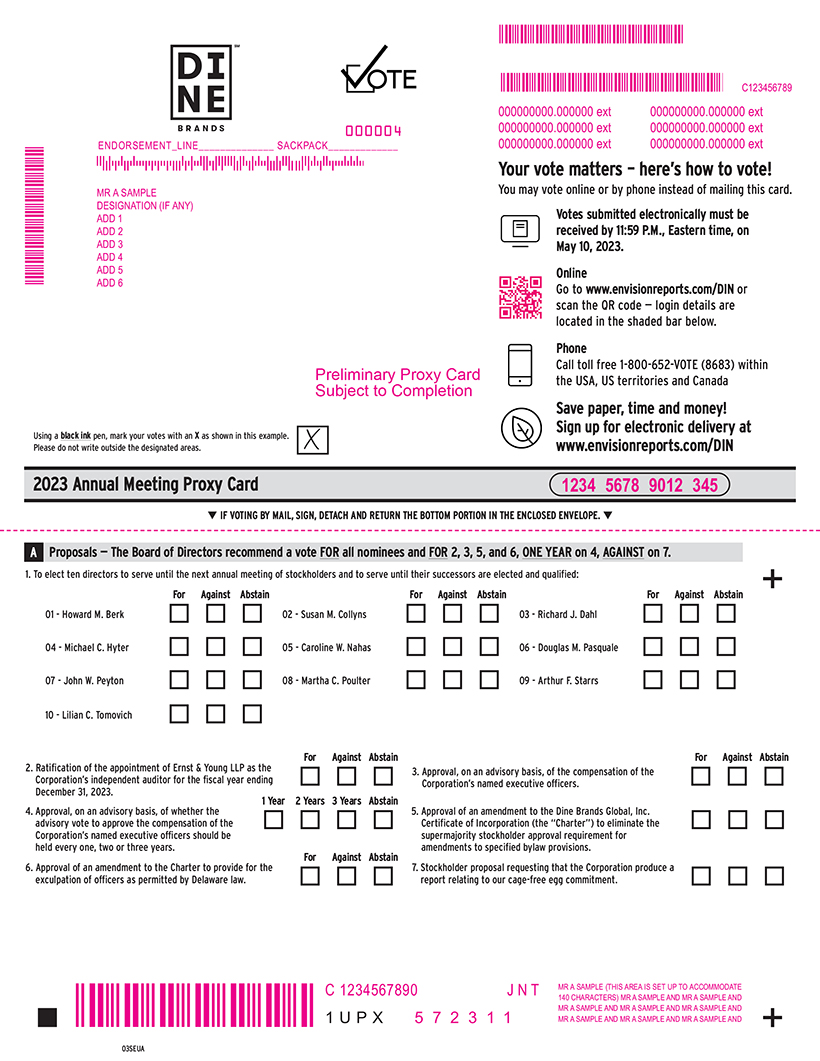

Board of Directors Nominations The Nominating and Corporate Governance Committee considers various criteria in evaluating Board of Directors candidates, including: business experience, board of directors experience, skills, expertise, education, professions, backgrounds, diversity, personal and professional integrity, character, business judgment, business philosophy, time availability in light of other commitments, dedication, conflicts of interest, and such other relevant factors that the Nominating and Corporate Governance Committee considers appropriate in the context of the needs of the Board of Directors. In considering diversity, the Nominating and Corporate Governance Committee evaluates candidates with a broad range of expertise, experience, skills, professions, education, backgrounds and other board of directors experience. While the Nominating and Corporate Governance Committee does not have a formal policy with respect to diversity, it considers diversity of race, gender and ethnicity as important factors in identifying directors who will bring diverse viewpoints, opinions and areas of expertise that will benefit the Board of Directors as a whole. The Nominating and Corporate Governance Committee does not assign specific weights to particular criteria in evaluating prospective nominees. The Nominating and Corporate Governance Committee also considers whether a potential nominee would satisfy the NYSE’s criteria for director “independence,” the NYSE’s “accounting or related financial management expertise” standard and the SEC’s definition of “audit committee financial expert.” Whenever a vacancy or potential vacancy exists on the Board of Directors due to expansion of the size of the Board of Directors or the resignation or retirement of an existing director, the Nominating and Corporate Governance Committee begins its process of identifying and evaluating potential director nominees. The Nominating and Corporate Governance Committee considers recommendations of members of the Board of Directors, management, stockholders and others. The Nominating and Corporate Governance Committee has sole authority to retain and terminate any search firm to be used to identify director candidates, including approving its fees and other retention terms. The Nominating and Corporate Governance Committee conducted an evaluation and assessment of each director whose term expires in 2023 for purposes of determining whether to recommend them for nomination for re-election to the Board of Directors. Current director Larry A. Kay will be retiring from the Board of Directors effective as of the Annual Meeting. In light of the retirement of Mr. Kay, the Nominating and Corporate Governance Committee engaged an independent search firm to assist it in evaluating potential director candidates, which is how Arthur F. Starrs was first identified as a candidate. Following this search, the Nominating and Corporate Governance Committee conducted an evaluation and assessment of Mr. Starrs for the purposes of determining whether to recommend him for nomination for election to the Board of Directors. The Nominating and Corporate Governance Committee determined to make a recommendation to the Board of Directors that Howard M. Berk, Susan M. Collyns, Richard J. Dahl, Michael C. Hyter, Caroline W. Nahas, Douglas M. Pasquale, John W. Peyton, Martha C. Poulter, and Lilian C. Tomovich be nominated for re-election to the Board of Directors and Arthur F. Starrs be nominated for election to the Board of Directors. After reviewing the assessment results, the Board of Directors reviewed and accepted the Nominating and Corporate Governance Committee’s recommendation and has nominated Howard M. Berk, Susan M. Collyns, Richard J. Dahl, Michael C. Hyter, Caroline W. Nahas, Douglas M. Pasquale, John W. Peyton, Martha C. Poulter, Arthur F. Starrs, and Lilian C. Tomovich for election to the Board of Directors. Stockholder Nominations The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders and will apply the same standards in considering director candidates recommended by stockholders that it applies to other candidates. Stockholders wishing to recommend director candidates for consideration by the Nominating and Corporate Governance Committee may do so by writing to the Secretary, giving the recommended nominee’s name, biographical data and qualifications, accompanied by the written consent of the recommended nominee to serve if elected. Any stockholder who wishes to directly nominate a director candidate to stand for election at a meeting of stockholders must provide written notice that is timely and in proper form in accordance with the advance notice procedures provided in the Corporation’s Bylaws. For more information, please refer to the discussion under the heading “Proposals of Stockholders.” | | | | 16 | |  |

| 2023 PROXY STATEMENT | DIRECTOR COMPENSATION |

DIRECTOR COMPENSATION Generally, the Corporation does not pay directors who are also employees of the Corporation additional compensation for their service on the Board of Directors. Compensation for non-employee directors is comprised of a cash component and an equity component. Cash compensation for non-employee directors includes retainers for serving as a member of the Board of Directors and for serving as a member and/or chair of a Board of Directors committee and as the Chair of the Board of Directors. During 2022, non-employee directors were entitled to receive $70,000 as an annual cash retainer for serving as a member of the Board of Directors. In addition, depending on their roles, non-employee directors were entitled to receive: $125,000 as an annual retainer for the Chairman of the Board of Directors; $15,000, $12,500, and $12,500, respectively, as an annual retainer for the chairs of the Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee; $12,500, $10,000, and $10,000, respectively, as an annual retainer for the members of the Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee; $1,500 per meeting beyond the eighth meeting of the Board of Directors attended for each director in a year; and $1,500 per meeting beyond the eighth meeting attended for each director who serves on a standing committee that meets more than eight times per year. The 2022 non-employee director compensation program did not change as compared to the 2021 non-employee director compensation program other than the Board of Directors’ approval of a fee of $1,500 per meeting beyond the eighth meeting of the Board of Directors attended by a director in a year. The Corporation also reimburses each of the directors for reasonable out-of-pocket expenses incurred for attendance at Board of Directors and committee meetings and other corporate events. Under the Corporation’s equity plan, non-employee directors may receive periodic grants of non-qualified stock options (“NQSOs”), restricted stock awards (“RSAs”), restricted stock units (“RSUs”), stock appreciation rights (“SARs”) or performance unit awards. In March 2022, equity awards valued at approximately $105,000 in the form of RSUs were granted to each non-employee director under the Corporation’s 2019 Stock Incentive Plan. Consistent with the non-employee director compensation program, annual equity awards granted to non-employee directors cliff vest on the one-year anniversary of the date of grant. In the event a director retires from the Board of Directors after completing five years of service, all of the director’s then-outstanding RSUs will vest. To the extent the Corporation declares dividends, non-employee directors receive dividend equivalent rights in the form of additional RSUs in lieu of receiving cash dividends based upon the number of RSUs held by the director at the time of the dividend record dates. Dividend equivalent rights are subject to the same vesting restrictions as the underlying RSUs. Directors are eligible to defer up to 100% of their annual Board of Directors retainer and committee fees and equity awards pursuant to the Dine Brands Global, Inc. Nonqualified Deferred Compensation Plan (the “Deferred Compensation Plan”). Effective January 1, 2023, the Board of Directors approved the following adjustments to director compensation: the annual cash retainer for non-employee directors was increased to $75,000 and the annual equity award was increased to a grant date fair value of $120,000. Stock Ownership Guidelines Non-employee directors are subject to stock ownership guidelines whereby each director is expected to hold the lesser of 7,000 shares of Common Stock or Common Stock with a value of at least five times the amount of the Board of Directors’ annual retainer (currently, $350,000). Directors are expected to meet the ownership guidelines within five years of joining the Board of Directors. Upon review by the Compensation Committee in 2022, all directors met, were on track to meet, or exceeded the ownership guidelines. | | |  | | 17 |

| 2023 PROXY STATEMENT | DIRECTOR COMPENSATION |

Director Compensation Table for 2022 The following table sets forth certain information regarding the compensation earned or paid in cash and stock awards granted to each non-employee director who served on the Board of Directors in 2022. Mr. Peyton did not receive any additional compensation for his service as a director in 2022. Please see the 2022 Summary Compensation Table for the compensation received by Mr. Peyton in his capacity as Chief Executive Officer. | | | | | | | | | | | | | | | Name | | Fees Earned or

Paid in Cash

($) | | Stock

Awards

($)(1)(2) | | | Total

($) | | | | | | Howard M. Berk | | 111,000 | | | 105,050 | | | | 216,050 | | | | | | Daniel J. Brestle(3) | | 29,205 | | | 105,050 | | | | 134,255 | | | | | | Susan M. Collyns | | 88,500 | | | 105,050 | | | | 193,550 | | | | | | Richard J. Dahl | | 225,000 | | | 105,050 | | | | 330,050 | | | | | | Michael C. Hyter | | 86,926 | | | 105,050 | | | | 191,976 | | | | | | Larry A. Kay | | 86,000 | | | 105,050 | | | | 191,050 | | | | | | Caroline W. Nahas | | 108,500 | | | 105,050 | | | | 213,550 | | | | | | Douglas M. Pasquale | | 103,500 | | | 105,050 | | | | 208,550 | | | | | | Martha Poulter | | 87,000 | | | 105,050 | | | | 192,050 | | | | | | Lilian C. Tomovich | | 93,000 | | | 105,050 | | | | 198,050 | |

| (1) | These amounts reflect the aggregate grant date fair value computed in accordance with Financial Accounting Standards Board’s Accounting Standards Codification Topic 718, Compensation—Stock Compensation (“FASB ASC Topic 718”). See Note 14 to the Consolidated Financial Statements in the Corporation’s annual report on Form 10-K for the fiscal year ended December 31, 2022 for information regarding assumptions underlying the valuation of equity awards. |

| (2) | The chart below identifies directors who are members and chairs of each committee as of the date of this proxy statement, the principal functions of each committee andfollowing table sets forth the number of meetingsRSUs held by each committeenon-employee director during 2019. The Board of Directors believes that committee rotation fosters the sharing of new perspectives2022 and enables directors with diverse skills and experiences to focus on different areas of oversight. The Nominating and Corporate Governance Committee regularly considers committee rotation and makes recommendations towhich were outstanding at December 31, 2022. |

| | | | | Name | | Stock Awards

Outstanding at

December 31, 2022

(#) | | | | Howard M. Berk | | | 1,532 | | | | Daniel J. Brestle(3) | | | 0 | | | | Susan M. Collyns | | | 1,532 | | | | Richard J. Dahl | | | 1,532 | | | | Michael C. Hyter | | | 1,532 | | | | Larry A. Kay | | | 1,532 | | | | Caroline W. Nahas | | | 4,437 | | | | Douglas M. Pasquale | | | 1,532 | | | | Martha Poulter | | | 1,532 | | | | Lilian C. Tomovich | | | 1,532 | |

| (3) | Mr. Brestle retired from the Board of Directors as appropriate.in May 2022. |

| | | | 18 | |  |

| | | | | | Name of Committee and

Membership

| | Principal Functions and Responsibilities | Audit Committee

Douglas M. Pasquale, Chair

Howard M. Berk

Susan M. Collyns

Richard J. Dahl

Gilbert T. Ray

| | • Appoint and oversee the work of the independent auditor in preparing or issuing an audit report or performing other audit, review or attest services for the Corporation.

• Review and discuss annual audited financial statements and quarterly financial statements, as well as Form10-Ks and Form10-Qs. Review and discuss earnings press releases and financial information and earnings guidance provided to analysts and rating agencies.

• Discuss the Corporation’s policies with respect to risk assessment and risk management and review and evaluate the guidelines and policies developed and implemented by management with respect to risk assessment and risk management. Oversee and review with the Board of Directors risk and risk mitigation associated with the Committee’s purpose and areas of responsibility, including accounting, auditing, financial reporting and internal controls over financial reporting. Review and discuss with the Board of Directors, at least annually and at the Board of Directors’ request, issues relating to the assessment and mitigation of major financial risks affecting the Corporation.

| Meetings in 2019

| | • Review risk assessments from management with respect to cybersecurity and oversee the

| Seven Meetings

| | Corporation’s cybersecurity risk management processes. Review risk assessments from

management with respect to food safety and quality assurance.

• Review the scope, progress and results of the internal audit program, including significant findings and recommendations and management’s responses.

• Review the Corporation’s program to monitor compliance with the Corporation’s Global Code of Conduct. Review any requests for waivers.

• Review and discuss the Corporation’s information technology program and overall trends in technology.

• Prepare the report required by the rules of the Securities and Exchange Commission to be included in the Corporation’s annual proxy statement.

• Review and approve all related party transactions (as defined under Item 404 of RegulationS-K and under the standards of the Public Company Accounting Oversight Board).

|

| | |  | | 11 |

| 2020 2023 PROXY STATEMENT

| CORPORATE GOVERNANCE |

| | | | | Name of Committee and

Membership

| | Principal Functions and Responsibilities | Compensation Committee

Daniel J. Brestle, Chair

Howard M. Berk

Caroline W. Nahas

| | • Review and approve the Corporation’s overall compensation philosophy and related compensation and benefits programs, policies and practices.

• Review and recommend for approval by the Board of Directors equity incentive compensation and other stock-based plans.

• Review and approve the performance goals and objectives for the Chief Executive Officer’s compensation and evaluate the Chief Executive Officer’s performance in light of these performance goals and objectives in order to determine and approve the Chief Executive Officer’s compensation package. Based on recommendations from the Chief Executive Officer, evaluate the performance of the other executive officers of the Corporation (which shall be the Corporation’s Section 16 officers under applicable Securities and Exchange Commission rules) and approve the compensation for such executive officers.

| Meetings in 2019

| | • Review and approve any changes to perquisites or other personal benefits provided to

| Seven Meetings

| | executive officers of the Corporation.

• Review and approve a peer group of companies against which to compare the Corporation’s executive compensation.

• Review compliance of each director and executive officer with the Corporation’s stock ownership guidelines and take any appropriate action in connection therewith.

• Review and approve any severance or termination arrangements to be made with any executive officer of the Corporation.

• Review the compensation package fornon-employee directors and recommend any changes for approval by the Board of Directors.

• Oversee and review with the Board of Directors risk and risk mitigation associated with the Committee’s purpose and areas of responsibility, including with respect to the Corporation’s compensation policies and practices. In doing so, consider and confirm that the Corporation’s compensation policies and practices do not encourage unnecessary risk taking.

• Assist the Board of Directors in developing and evaluating potential candidates for executive management positions, including the Chief Executive Officer, and oversee the development of executive succession plans.

• Maintain visibility into, assist with the development of, and monitor progress of programs regarding the Corporation’s organizational culture, including diversity and inclusion.

• Review and approve the Compensation Discussion and Analysis to be included in the Corporation’s annual proxy statement.

|

| | | 12 | |  |

| 2020 PROXY STATEMENT

| CORPORATE GOVERNANCE

|

| | | | | Name of Committee and

Membership

| | Principal Functions and Responsibilities | Nominating and Corporate

Governance Committee

Caroline W. Nahas, Chair

Richard J. Dahl

Larry A. Kay

Lilian C. Tomovich

| | • Oversee succession planning for the Board of Directors and consider the size and composition of the Board of Directors as a whole. Make appropriate recommendations regarding such matters to the Board of Directors for approval.

• Identify and evaluate qualified director candidates, including any candidates validly nominated by the Corporation’s stockholders, and recommend director nominees for approval by the Board of Directors.

• Determine the skills and qualifications required for directors and develop criteria to be considered in identifying and evaluating director candidates. In developing such criteria, the Committee should consider diversity of experience, skills, background, gender, race and ethnicity as important factors.

• Consider the suitability of existing directors for continued service on the Board of Directors when his or her term expires and when he or she has a change in status, including changes to employment and outside board of directors service, and make appropriate recommendations regarding such matters to the Board of Directors for approval.

| Meetings in 2019

| | • Develop and review the Corporation’s Corporate Governance Guidelines and recommend

| Five Meetings

| | any changes to the Corporate Governance Guidelines for approval by the Board of Directors.

• Consider and recommend for approval by the Board of Directors matters pertaining to committees of the Board of Directors, including with respect to structure, member qualifications, composition, committee chairs and committee reporting to the Board of Directors.

• Consider and recommend for approval by the Board of Directors the Chairman of the Board of Directors.

• Review the Code of Conduct forNon-Employee Directors and the Corporation’s Global Code of Conduct and recommend any changes for approval by the Board of Directors.

• Oversee and review with the Board of Directors risk and risk mitigation associated with the Committee’s purpose and areas of responsibility, including Board of Directors’ organization, membership and structure, succession planning, director independence, Board of Directors effectiveness and other corporate governance matters.

• Work with the Chairman of the Board of Directors to oversee the evaluation of the performance and effectiveness of the Board of Directors and each committee of the Board of Directors.

• Coordinate an annual corporate governance training for the Board of Directors.

• Review and oversee the Corporation’s actions on issues related to corporate social responsibility, sustainability, philanthropy, and other matters associated with the Corporation’s participation as a global corporate citizen.

• Review and oversee the Corporation’s political activities and contributions and other public policy issues to ensure alignment with the Corporation’s long-term strategy and values.

|

| | |  | | 13 |

| 2020 PROXY STATEMENT

| CORPORATE GOVERNANCE

|

Board of Directors Nominations

The Nominating and Corporate Governance Committee considers various criteria in evaluating Board of Directors candidates, including: business experience, board of directors experience, skills, expertise, education, professions, backgrounds, diversity, personal and professional integrity, character, business judgment, business philosophy, time availability in light of other commitments, dedication, conflicts of interest, and such other relevant factors that the Nominating and Corporate Governance Committee considers appropriate in the context of the needs of the Board of Directors. In considering diversity, the Nominating and Corporate Governance Committee evaluates candidates with a broad range of expertise, experience, skills, professions, education, backgrounds and other board of directors experience. While the Nominating and Corporate Governance Committee does not have a formal policy with respect to diversity, it considers diversity of race, gender and ethnicity as important factors in identifying directors who will bring diverse viewpoints, opinions and areas of expertise that will benefit the Board of Directors as a whole. To further demonstrate its commitment to seeking diversity of race, gender and ethnicity in its consideration of director candidates, the Nominating and Corporate Governance Committee added these important factors to its charter in August 2019 as criteria to be considered in identifying and evaluating director candidates. The Nominating and Corporate Governance Committee does not assign specific weights to particular criteria in evaluating prospective nominees.

The Nominating and Corporate Governance Committee also considers whether a potential nominee would satisfy the NYSE’s criteria for director “independence,” the NYSE’s “accounting or related financial management expertise” standard and the SEC’s definition of “audit committee financial expert.”

Whenever a vacancy or potential vacancy exists on the Board of Directors due to expansion of the size of the Board of Directors or the resignation or retirement of an existing director, the Nominating and Corporate Governance Committee begins its process of identifying and evaluating potential director nominees. The Nominating and Corporate Governance Committee considers recommendations of members of the Board of Directors, management, stockholders and others. The Nominating and Corporate Governance Committee has sole authority to retain and terminate any search firm to be used to identify director candidates, including approving its fees and other retention terms.

The Nominating and Corporate Governance Committee conducted an evaluation and assessment of each director whose term expires in 2020 for purposes of determining whether to recommend them for nomination forre-election to the Board of Directors. After reviewing the assessment results, the Nominating and Corporate Governance Committee determined to make a recommendation to the Board of Directors that Howard M. Berk, Daniel J. Brestle, Caroline W. Nahas, Gilbert T. Ray, Larry A. Kay, Douglas M. Pasquale and Susan M. Collyns be nominated forre-election to the Board of Directors. The Board of Directors reviewed and accepted the Nominating and Corporate Governance Committee’s recommendation and has nominated Howard M. Berk, Daniel J. Brestle, Caroline W. Nahas, Gilbert T. Ray, Larry A. Kay, Douglas M. Pasquale and Susan M. Collyns forre-election to the Board of Directors.

Stockholder Nominations

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders and will apply the same standards in considering director candidates recommended by stockholders that it applies to other candidates. Stockholders wishing to recommend director candidates for consideration by the Nominating and Corporate Governance Committee may do so by writing to the Secretary, giving the recommended nominee’s name, biographical data and qualifications, accompanied by the written consent of the recommended nominee to serve if elected. Any stockholder who wishes to directly nominate a director candidate to stand for election at a meeting of stockholders must provide written notice that is timely and in proper form in accordance with the advance notice procedures provided in the Corporation’s Bylaws.

Environmental, Social and Governance Highlights

In executing on the Corporation’s strategic priorities, we recognize our responsibility to drive long-term stockholder value through ethical business practices that make sense for our business, our guests and our communities. Pursuant to its charter, our Nominating and Corporate Governance Committee has the responsibility to review and oversee the Corporation’s actions on issues related to corporate social responsibility, sustainability, philanthropy and other matters associated with the Corporation’s participation as a global corporate citizen. Our corporate social responsibility efforts are organized into the following categories: supporting our neighborhoods, caring for the environment and valuing our team members.

| | | 14 | |  |

| 2020 PROXY STATEMENT

| CORPORATE GOVERNANCE

|

Supporting our neighborhoods.

We value the neighborhoods in which we do business. Together with our franchisees and team members, we make a difference by giving back to the communities where we operate. Every year, we support hundreds of fundraisers and events taking place across the country through our charitable foundation, volunteering, and team member donations. Some highlights include:

Alex’s Lemonade Stand: Since 2005, Applebee’s franchisees have raised nearly $10.2 million in support of research to help in the fight against childhood cancer.

National Pancake Day: An annual IHOP event which has raised over $30 millionto-date in support of Children’s Miracle Network Hospitals and other local charities. National Pancake Day is also celebrated at IHOPs in Mexico, Canada, Guam, and Puerto Rico.

Veteran’s Day: Since 2008, more than 9.8 million free meals have been donated by Applebee’s to veteran and active military personnel in recognition and gratitude for their service.

We also seek to engage our team members in community-investment and development initiatives that serve the communities where we live and operate. An annual Philanthropic Day provides paid time off for our team members, giving them an opportunity to volunteer a full day to support a philanthropic effort of their choice.

Caring for the environment.

Animal Welfare

Animal welfare is an issue of critical importance for us and we are continuing to work with our suppliers, animal welfare experts and others both in and outside the industry to align on solutions and best practices that are supported by science and rigorous research. We are committed to an animal welfare policy that is rooted in sustainable progress and accountability. For example, we ask our chicken and pork suppliers to prohibit the routine use of medically important antibiotics as defined by the World Health Organization, including prohibiting the use of these antibiotics for disease prevention. We also undertake an annual internal compliance review of our animal protein suppliers’ established animal handling procedures, including by requesting relevant third-party farm and plant animal audits, to facilitate informed sourcing decisions. We are working towards using shelled and liquid eggs in the U.S. that are derived 100% from hens housed in a cage-free environment.

Environmental

We are focused on identifying ways to reduce our impact on the environment through improvements in how we supply, design, build and maintain our restaurants. In addition, our IHOP® and Applebee’s® Restaurant Support Center is housed in a LEED Platinum Certified building.

We source a large amount of paper and plastic goods for our restaurants. We are working towards reducing the amount of polystyrene used in our “to go” orders and replacing these packaging products with recyclable packaging.

We continue working to reduce the energy consumption in our restaurants and our restaurant support center. For example, nearly all offices in our innon-restaurant facilities have motion-activated light switches that automatically lower or turn off the lights if no movement is detected after a period of time. We have also been aggressive about replacing traditional lighting with compact florescent lighting wherever practicable.

Valuing our team members.

We operate under a cultural framework based on shared values and strategic pillars which define who we are and how we work. We value, encourage and recognize the diversity and inclusion of our workforce and the benefits that an array of backgrounds, cultures and thinking styles bring to our organization. We are committed to creating an environment that accepts, includes and engages everyone in our workforce and encourages open dialogue. Substantially all of our restaurant support center team members undertake a comprehensive diversity and inclusion training seminar. Our Chief Executive Officer, Stephen P. Joyce, has taken the CEO Action for Diversity and Inclusion Pledge.

We are focused on identifying diverse director candidates as demonstrated by the addition of race, gender and ethnicity as important factors for the Nominating and Corporate Governance Committee to consider when identifying director candidates. In 2019, the Compensation Committee also added the responsibility to oversee the Corporation’s organizational culture, including diversity and inclusion, to its committee charter.

| | |  | | 15 |

| 2020 PROXY STATEMENT

| DIRECTOR COMPENSATION

|

DIRECTOR COMPENSATION

Generally, the Corporation does not pay directors who are also employees of the Corporation additional compensation for their service on the Board of Directors. Compensation fornon-employee directors is comprised of a cash component and an equity component. Cash compensation fornon-employee directors includes retainers for serving as a member of the Board of Directors and for serving as a member and/or chair of a Board of Directors committee and as the Chairman of the Board of Directors.

During 2019,non-employee directors were entitled to receive $70,000 as an annual cash retainer for serving as a member of the Board of Directors. In addition, depending on their roles,non-employee directors were entitled to receive:

$125,000 as an annual retainer for the Chairman of the Board of Directors;

$15,000, $12,500 and $7,500, respectively, as an annual retainer for the chairs of the Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee;

$12,500, $10,000 and $7,500, respectively, as an annual retainer for the members of the Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee; and

$1,500 per meeting beyond the eighth meeting attended for each director who serves on a standing committee that meets more than eight times per year.

The Corporation also reimburses each of the directors for reasonableout-of-pocket expenses incurred for attendance at Board of Directors and committee meetings and other corporate events.

Under the Corporation’s equity plan,non-employee directors may receive periodic grants ofnon-qualified stock options (“NQSOs”), restricted stock awards (“RSAs”), restricted stock units (“RSUs”), stock appreciation rights (“SARs”) or performance unit awards. In February 2019, equity awards valued at approximately $105,000 in the form of RSUs were granted to eachnon-employee director under the 2016 Stock Incentive Plan. Annual equity awards granted tonon-employee directors from 2019 forward are subject to aone-year cliff vesting from the date of grant, while annual RSU grants tonon-employee directors prior to 2019 are subject to three-year cliff vesting from the date of grant. In the event a director retires from the Board of Directors after completing five years of service, all of the director’s then-outstanding RSUs will vest. To the extent the Corporation declares dividends,non-employee directors receive dividend equivalent rights in the form of additional RSUs in lieu of receiving cash dividends based upon the number of RSUs held by the director at the time of the dividend record dates. Dividend equivalent rights are subject to the same vesting restrictions as the underlying RSUs.

Directors are eligible to defer up to 100% of their annual Board of Directors retainer and committee fees and equity award compensation pursuant to the Dine Brands Global, Inc. Nonqualified Deferred Compensation Plan (the “Deferred Compensation Plan”).

Stock Ownership Guidelines

Non-employee directors are subject to stock ownership guidelines whereby each director is expected to hold the lesser of 7,000 shares of Common Stock or Common Stock with a value of at least five times the amount of the Board of Directors’ annual retainer (currently, $350,000). Directors are expected to meet the ownership guidelines within five years of joining the Board of Directors. Upon review by the Compensation Committee in 2019, all directors met, were on track to meet, or exceeded the ownership guidelines.

| | | 16 | |  |

| 2020 PROXY STATEMENT

| DIRECTOR COMPENSATION

|

Director Compensation Table for 2019

The following table sets forth certain information regarding the compensation earned or paid in cash and stock awards granted to eachnon-employee director who served on the Board of Directors in 2019. Mr. Joyce did not receive any additional compensation for his service as a director in 2019. Please see the 2019 Summary Compensation Table for the compensation received by Mr. Joyce in his capacity as Chief Executive Officer.

| | | | | | | | | | | | | | | | | | | | Name | | Fees Earned or

Paid in Cash

($) | | Stock

Awards

($)(1)(2) | | Total

($) | | | | | Howard M. Berk | | 92,500 | | | | 105,007 | | | | | 197,507 | | | | | | Daniel J. Brestle | | 92,500 | | | | 105,007 | | | | | 197,507 | | | | | | Susan M. Collyns(3) | | 34,413 | | | | 105,050 | | | | | 139,463 | | | | | | Richard J. Dahl | | 212,257 | | | | 105,007 | | | | | 317,264 | | | | | | Larry A. Kay | | 77,500 | | | | 105,007 | | | | | 182,507 | | | | | | Caroline W. Nahas(4) | | 95,000 | | | | 105,007 | | | | | 200,007 | | | | | | Douglas M. Pasquale | | 100,500 | | | | 105,007 | | | | | 205,507 | | | | | | Gilbert T. Ray | | 82,500 | | | | 105,007 | | | | | 187,507 | | | | | | Lilian C. Tomovich | | 77,500 | | | | 105,007 | | | | | 182,507 | |

(1) | These amounts reflect the aggregate grant date fair value computed in accordance with Financial Accounting Standards Board’s Accounting Standards Codification Topic 718,Compensation—Stock Compensation (“FASB ASC Topic 718”). See Note 14 to the Consolidated Financial Statements in the Corporation’s annual report on Form10-K for the fiscal year ended December 31, 2019 for information regarding assumptions underlying the valuation of equity awards.

|

(2) | The following table sets forth the number of RSUs held by eachnon-employee director during 2019 and which were outstanding at December 31, 2019.

|

| | | | | Name

| | Stock Awards

Outstanding at

December 31, 2019

(#) | | | | Howard M. Berk

| | | 4,958 | | | | Daniel J. Brestle

| | | 4,958 | | | | Susan M. Collyns(3)

| | | 1,262 | | | | Richard J. Dahl

| | | 4,958 | | | | Larry A. Kay

| | | 4,958 | | | | Caroline W. Nahas

| | | 4,958 | | | | Douglas M. Pasquale

| | | 4,958 | | | | Gilbert T. Ray

| | | 4,958 | | | | Lilian C. Tomovich

| | | 4,271 | |

(3) | Ms. Collyns was appointed as a director on August 1, 2019. Ms. Collyns’ retainer fees were prorated for the period of time Ms. Collyns served as a director.

|

(4) | Ms. Nahas elected to defer all of her 2019 director cash compensation and annualnon-employee director equity awards pursuant to the Deferred Compensation Plan.

|

| | |  | | 17 |

| 2020 PROXY STATEMENT

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT Security Ownership of Certain Beneficial Owners

The following table sets forth information regarding beneficial ownership of more than 5% of the outstanding shares of any class of the Corporation’s voting securities, which information is derived solely from certain SEC filings available as of March 18, 2020, as noted below. The percentages of Common Stock ownership have been calculated based upon 16,593,808 shares of Common Stock outstanding as of March 18, 2020.

| | | | | | | | | | | | | | Shares of Common

Stock Beneficially

Owned | | | | | Name and Address of Beneficial Owner | | Number | | | Percent | | | | | BlackRock, Inc. 55 East 52nd Street New York, NY 10055 | | | 2,473,956 | (1) | | | 15.01 | % | | | | The Vanguard Group 100 Vanguard Blvd. Malvern, PA 19355 | | | 2,112,747 | (2) | | | 12.81 | % | | | | Capital Research Global Investors 333 South Hope Street Los Angeles, CA 90071 | | | 2,039,724 | (3) | | | 12.37 | % | | | | Wells Fargo & Company 420 Montgomery Street San Francisco, CA 94163 | | | 1,470,361 | (4) | | | 8.92 | % |

(1) | Based solely upon on a Schedule 13G/A filed with the SEC on February 4, 2020 by BlackRock, Inc. reporting beneficial ownership as of December 31, 2019. BlackRock, Inc. reported that it possessed sole power to vote or direct the vote with respect to 2,441,677 of these shares and sole power to dispose or direct the disposition of 2,473,956 of these shares.

|

(2) | Based solely upon on a Schedule 13G/A filed with the SEC on February 11, 2020 by The Vanguard Group reporting beneficial ownership as of December 31, 2019. The Vanguard Group reported that it possessed sole power to vote or direct the vote with respect to 26,131 shares, shared power to vote or direct the vote with respect to 2,901 shares, sole power to dispose or direct the disposition of 2,085,732 shares and shared power to dispose or to direct the disposition of 27,015 of these shares.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT Security Ownership of Certain Beneficial Owners The following table sets forth information regarding beneficial ownership of more than 5% of the outstanding shares of any class of the Corporation’s voting securities, which information is derived solely from certain SEC filings available as of March 17, 2023, as noted below. The percentages of Common Stock ownership have been calculated based upon 15,718,577 shares of Common Stock outstanding as of March 17, 2023. |

(3) | Based solely upon a Schedule 13G/A filed with the SEC on February 14, 2020 by Capital Research Global Investors reporting beneficial ownership as of December 31, 2019. Capital Research Global Investors reported that it possessed sole power to vote or direct the vote and sole power to dispose or direct the disposition of all of the shares indicated in the table above. | | | | | | | | | | | | | | Shares of Common

Stock Beneficially

Owned | | | | | Name and Address of Beneficial Owner | | Number | | | Percent | | | | | BlackRock, Inc. 55 East 52nd Street New York, NY 10055 | | | 2,423,273 | (1) | | | 15.4% | | | | | The Vanguard Group 100 Vanguard Blvd. Malvern, PA 19355 | | | 1,965,964 | (2) | | | 12.5% | | | | | AllianceBernstein L.P. 1345 Avenue of the Americas New York, NY 10105 | | | 1,743,245 | (3) | | | 11.1% | | | | | Allspring Global Investments Holdings, LLC 525 Market St., 10th Fl. San Francisco, CA 94105 | | | 1,264,768 | (4) | | | 8.0% | |

| (1) | Based solely upon on a Schedule 13G/A filed with the SEC on January 26, 2023 by BlackRock, Inc. reporting beneficial ownership as of December 31, 2022. BlackRock, Inc. reported that it possessed sole power to vote or direct the vote with respect to 2,402,022 of these shares and sole power to dispose or direct the disposition of 2,423,273 of these shares. |

| (2) | Based solely upon on a Schedule 13G/A filed with the SEC on February 9, 2023 by The Vanguard Group reporting beneficial ownership as of December 31, 2022. The Vanguard Group reported that it possessed shared power to vote or direct the vote with respect to 31,405 shares, sole power to dispose or direct the disposition of 1,920,019 shares and shared power to dispose or to direct the disposition of 45,945 of these shares. |

| (3) | Based solely upon a Schedule 13G/A filed with the SEC on February 14, 2023 by AllianceBernstein L.P. reporting beneficial ownership as of December 31, 2022. AllianceBernstein, L.P. reported that it possessed sole power to vote or direct the vote of 1,496,392 of these shares and sole power to dispose or direct the disposition of 1,743,245 of these shares. |

| (4) | Based solely upon a Schedule 13G/A filed with the SEC on January 13, 2023 by (i) Allspring Global Investments Holdings, LLC (“AGIH”), (ii) Allspring Global Investments, LLC (“AGI”), and (iii) Allspring Funds Management, LLC (“AFM”) reporting beneficial ownership as of December 31, 2022. AGIH reported that it possessed sole power to vote or direct the vote of 1,224,061 shares and sole power to dispose or direct the disposition of 1,264,768 shares. AGI reported that it possessed sole power to vote or direct the vote of 197,938 shares and sole power to dispose or direct the disposition of 1,262,766 shares. AFM reported that it possessed sole power to vote or direct the vote of 1,026,123 shares and sole power to dispose or direct the disposition of 2,002 shares. |

| | |  | | 19 |

| (4) | Based solely upon a Schedule 13G filed with the SEC on February 4, 2020 by Wells Fargo & Company reporting beneficial ownership as of December 31, 2019. Wells Fargo & Company reported that it possessed the sole power to vote or direct the vote with respect to 23,086 shares, shared power to vote or direct the vote with respect to 241,895 shares, sole power to dispose or direct the disposition of 23,086 shares and shared power to dispose or direct the disposition of 1,447,275 of these shares.

|

| | | 18 | |  |

| 2020 2023 PROXY STATEMENT

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

Security Ownership of Management The following table sets forth, as of March 17, 2023, the beneficial ownership of the Corporation’s Common Stock, including shares as to which a right to acquire ownership exists within the meaning of Rule 13d-3(d)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), within 60 days of March 17, 2023, of each director, each nominee for election as director, each named executive officer and all directors and executive officers of the Corporation, as a group. The percentages of ownership have been calculated based upon 15,718,577 shares of Common Stock outstanding as of March 17, 2023. | | | | | | | | | | | | | | | | | | | | | | | | Amount and Nature of

Beneficial Ownership | | | | | | | | | | | | | Name | | Shares

Beneficially

Owned(1) | | | Unvested

Restricted

Shares(2) | | | Total Shares

Beneficially

Owned | | | Percent of Class | | | | | | | Howard M. Berk | | | 35,016 | (3)(4) | | | — | | | | 35,016 | | | | * | | | | | | | Susan M. Collyns | | | 4,662 | | | | — | | | | 4,662 | | | | * | | | | | | | Richard J. Dahl | | | 74,771 | (3)(5) | | | — | | | | 74,771 | | | | * | | | | | | | Michael C. Hyter | | | 2,872 | | | | — | | | | 2,872 | | | | * | | | | | | | Larry A. Kay | | | 21,105 | (3)(6) | | | — | | | | 21,150 | | | | * | | | | | | | Caroline W. Nahas | | | 35,056 | (3) | | | — | | | | 35,056 | | | | * | | | | | | | Douglas M. Pasquale | | | 17,174 | (3)(7) | | | — | | | | 17,174 | | | | * | | | | | | | Martha C. Poulter | | | 1,970 | | | | — | | | | 1,970 | | | | * | | | | | | | Arthur F. Starrs | | | — | | | | — | | | | — | | | | * | | | | | | | Lilian C. Tomovich | | | 8,182 | (3) | | | — | | | | 8,182 | | | | * | | | | | | | John W. Peyton | | | 87,458 | | | | 36,670 | | | | 124,128 | | | | * | | | | | | | Vance Y. Chang | | | 5,255 | | | | 16,577 | | | | 21,832 | | | | * | | | | | | | Jay D. Johns | | | 46,138 | | | | 12,630 | | | | 58,768 | | | | * | | | | | | | Tony E. Moralejo | | | 15,806 | | | | 9,493 | | | | 25,299 | | | | * | | | | | | | Christine K. Son | | | 39,311 | | | | 11,063 | | | | 50,374 | | | | * | | | | | | | All directors and executive officers as a group (15 persons) | | | 394,822 | | | | 86,433 | | | | 481,255 | | | | 3.03% | |

| * | Represents less than 1% of the outstanding shares of Common Stock. |

| | | | 20 | |  |

| 2023 PROXY STATEMENT | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

| (1) | Security Ownership of Management

The following table sets forth, as of March 18, 2020, the beneficial ownershipNone of the Corporation’s Common Stock, including shares have been pledged as to which a right to acquire ownership exists withinsecurity. Share amounts for each of the meaning ofRule 13d-3(d)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), within 60 days of March 18, 2020, of each director,directors, each nominee for election as director, each named executive officer and for all directors and executive officers as a group include shares subject to stock options that are exercisable within 60 days of March 17, 2023, as follows:

|

| | | Name | | Shares Subject to Options | | | Howard M. Berk | | — | | | Susan M. Collyns | | — | | | Richard J. Dahl | | 27,000 | | | Michael C. Hyter | | — | | | Larry A. Kay | | — | | | Caroline W. Nahas | | — | | | Douglas M. Pasquale | | — | | | Martha C. Poulter | | — | | | Arthur F. Starrs | | — | | | Lilian C. Tomovich | | — | | | John W. Peyton | | 47,834 | | | Vance Y. Chang | | 2,888 | | | Jay D. Johns | | 35,117 | | | Tony E. Moralejo | | 8,113 | | | Christine K. Son | | 30,827 | | | All directors and executive officers as a group (15 persons) | | 151,779 |

| Directors and certain executive officers also hold RSUs that are not included in the beneficial ownership table because vesting will not occur within 60 days of March 17, 2023. The amounts of RSUs held by non-employee directors as of December 31, 2022 are provided in the section of this proxy statement entitled “Director Compensation” and the amounts of RSUs held by executive officers are provided in the Outstanding Equity Awards at Fiscal Year-End Table. |

| (2) | Unvested RSAs are deemed beneficially owned because grantees of unvested RSAs under the Corporation’s equity compensation plans hold the sole right to vote such shares. |

| (3) | Includes unvested RSUs for Mr. Berk 1,602; Mr. Dahl 1,602; Mr. Kay 1,602; Ms. Nahas 1,602; Mr. Pasquale 1,602; and Ms. Tomovich 1,602. Each RSU represents a contingent right to receive one share of common stock. There are no voting rights associated with RSUs. |

| (4) | The amount for Mr. Berk does not include 740,545 shares of the Corporation, asCorporation’s Common Stock beneficially owned by Coral Rock Investments, L.P. MSD Capital, L.P. is the general partner of Coral Rock Investments, L.P. and may be deemed to beneficially own securities owned by Coral Rock Investments, L.P. Mr. Berk is a group. Senior Advisor of BDT & MSD Partners and may be deemed to beneficially own securities owned by MSD Capital, L.P. Mr. Berk disclaims beneficial ownership of the shares that may be deemed to be beneficially owned by MSD Capital, L.P., except to the extent of his pecuniary interest therein. |

| (5) | The percentages of ownership have been calculated based upon 16,593,808amount for Mr. Dahl includes 46,169 shares of Common Stock outstandingheld by the Richard J. Dahl Revocable Living Trust dated 1/20/1995, of which Mr. Dahl serves as Trustee. |

| (6) | The amount for Mr. Kay includes 11,909 shares of March 18, 2020.Common Stock held by the IRA Trustee for the benefit of Mr. Kay. |

| (7) | The amount for Mr. Pasquale includes 14,029 shares of Common Stock held by the Pasquale Living Trust. |

| | |  | | 21 |

| 2023 PROXY STATEMENT | | | | | | | | | | | | | | | | | | | | | | | | Amount and Nature of

Beneficial Ownership | | | | | | | | | | | | | Name | | Shares

Beneficially

Owned(1) | | | Unvested

Restricted

Shares(2) | | | Total Shares

Beneficially

Owned | | | Percent of Class | | | | | | | Howard M. Berk | | | 30,487 | (3)(4) | | | — | | | | 27,651 | | | | * | | | | | | | Daniel J. Brestle | | | 24,487 | (3) | | | — | | | | 21,651 | | | | * | | | | | | | Susan M. Collyns | | | — | | | | — | | | | — | | | | * | | | | | | | Richard J. Dahl | | | 77,079 | (3)(5) | | | — | | | | 74,243 | | | | * | | | | | | | Larry A. Kay | | | 25,445 | (3)(6) | | | — | | | | 22,609 | | | | * | | | | | | | Caroline W. Nahas | | | 31,187 | (3) | | | — | | | | 29,982 | | | | * | | | | | | | Douglas M. Pasquale | | | 12,645 | (3)(7) | | | — | | | | 9,809 | | | | * | | | | | | | Gilbert T. Ray | | | 14,555 | (3) | | | — | | | | 11,719 | | | | * | | | | | | | Lilian C. Tomovich | | | 2,672 | | | | — | | | | 2,672 | | | | * | | | | | | | Stephen P. Joyce | | | 10,775 | | | | — | | | | 10,775 | | | | * | | | | | | | Thomas H. Song | | | 9,983 | | | | 18,489 | | | | 28,472 | | | | * | | | | | | | Jay D. Johns | | | 19,344 | (8) | | | 15,680 | | | | 35,024 | | | | * | | | | | | | John C. Cywinski | | | 98,865 | | | | 17,503 | | | | 116,368 | | | | * | | | | | | | Bryan R. Adel | | | 45,330 | | | | 7,290 | | | | 52,620 | | | | * | | | | | | | All directors and executive officers as a group (14 persons) | | | 402,854 | | | | 58,962 | | | | 461,816 | | | | 2.75% | |

| * | Represents less than 1% of the outstanding shares of Common Stock.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE |

| | |  | | 19 |

| 2020 PROXY STATEMENT

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE Section 16(a) of the Exchange Act requires that the Corporation’s directors, executive officers and persons who own more than ten percent of the Corporation’s equity securities file reports of ownership and changes in ownership with the SEC. Based on its review of such reports and other information furnished by the directors and executive officers, the Corporation believes that all reports required to be filed pursuant to Section 16(a) of the Exchange Act were filed on a timely basis in 2022 except for one report which was filed on September 13, 2022 in connection with vesting on September 1, 2022 of RSUs granted to director Martha C. Poulter. | | | | 22 | |  | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

| 2023 PROXY STATEMENT | EXECUTIVE COMPENSATION |

(1) | None of the shares have been pledged as security. Share amounts for each of the directors, each nominee for election as director, each named executive officer and for all directors and executive officers as a group include shares subject to stock options that are exercisable within 60 days of March 18, 2020, as follows:

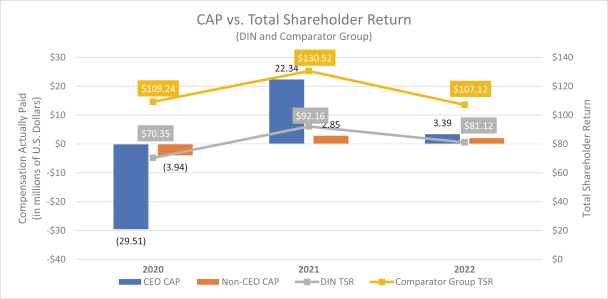

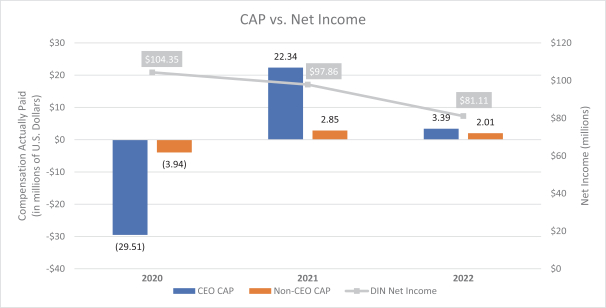

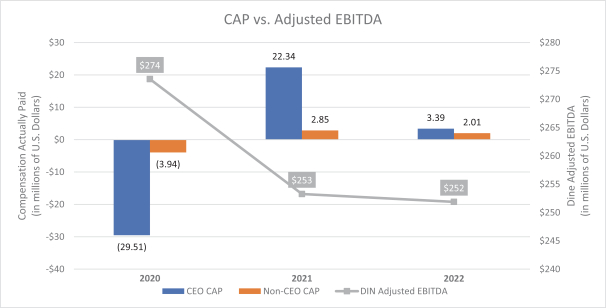

EXECUTIVE COMPENSATION COMPENSATION COMMITTEE REPORT The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management. Based on its review and discussion, the Compensation Committee recommended that the Board of Directors include the Compensation Discussion and Analysis in this proxy statement and the Corporation’s annual report on Form 10-K. THIS REPORT IS SUBMITTED BY THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS Howard M. Berk (Chair) Caroline W. Nahas Lilian C. Tomovich COMPENSATION DISCUSSION AND ANALYSIS The following discussion provides an overview and analysis of the Corporation’s compensation programs and policies, the material compensation decisions made under those programs and policies with respect to the Corporation’s named executive officers (the “NEOs”) and the material factors that were considered in making those decisions. Following this Compensation Discussion and Analysis is a series of tables under the heading “Compensation Tables” containing specific data about the compensation earned by or granted to our NEOs in 2022. The following executive officers were NEOs in 2022: Chief Executive Officer, John W. Peyton; Chief Financial Officer, Vance Y. Chang; President of the Applebee’s Business Unit, John C. Cywinski; President of the IHOP Business Unit, Jay D. Johns; and Senior Vice President, Legal, General Counsel and Secretary, Christine K. Son. Effective January 6, 2023, Mr. Cywinski resigned as President, Applebee’s Business Unit and Tony E. Moralejo became our President, Applebee’s Business Unit. Executive Summary 2022 Fiscal Year Performance Highlightsand Link to Pay Decisions: Our compensation decisions for 2022 were driven by our overarching goals of creating long-term stockholder value and linking pay with performance. Our 2022 performance was impacted by the ongoing COVID-19 pandemic, the inflationary environment, and supply chain issues, each of which affected performance results. However, despite these headwinds, we delivered steady performance and continued to return capital to stockholders via dividends and buybacks. Highlights include the following: Total 2022 revenues were $909.4 million, compared to $896.2 million for 2021. Consolidated adjusted EBITDA for 2022 was $251.9 million, compared to $253.3 million for 2021. Adjusted EBITDA is a performance measure used in our annual cash incentive plan. GAAP earnings per diluted share of $4.96 for 2022, compared to $5.66 for 2021. Development activity by Applebee’s and IHOP franchisees for 2022 resulted in the opening of 67 new restaurants and the closure of 39 restaurants, a net gain of 28 restaurants. Adjusted EBITDA for the Applebee’s Business Unit and IHOP Business Unit represented 101% and 97% of our incentive targets, respectively. | | |  | | 23 |

| 2023 PROXY STATEMENT | EXECUTIVE COMPENSATION |

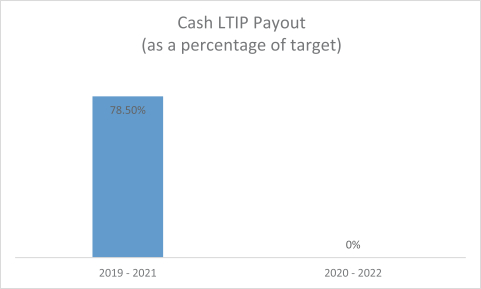

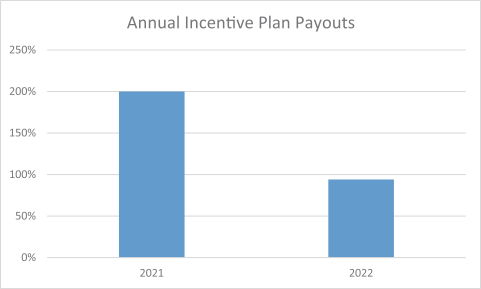

| | | Name

• Same-restaurant sales in our domestic Applebee’s and IHOP restaurants increased by 5.1% and 5.8%, respectively. We completed the acquisition of Fuzzy’s Taco Shop, adding a new and growing category to our portfolio of brands. We believe that the Corporation’s 2022 compensation results were commensurate with the Corporation’s performance in 2022, demonstrating our commitment to a pay-for-performance philosophy. The Corporation’s 2022 annual cash incentive plan paid out at approximately 94% of target for Dine Brands, 119% of target for the Applebee’s Business Unit and 66% of target for the IHOP Business Unit. The following chart shows the annual cash incentive plan payout for 2022 and 2021 for Dine Brands. | | Shares Subject to

Options

The cash LTIP plan for 2020-2022 did not pay out based on our relative TSR performance at the 29.6th percentile relative to an index of publicly traded restaurant companies. | |  |

| † | For complete information regarding the Corporation’s 2022 performance, stockholders should read “Management’s Discussion and Analysis of Results of Operation and Financial Condition” and the audited consolidated financial statements and accompanying notes thereto contained in the Corporation’s 2022 annual report on Form 10-K filed with the SEC on March 1, 2023, which is being made available to stockholders with this proxy statement. |

| | | | 24 | |  |

| Howard M. Berk

| | — | | | Daniel J. Brestle

| | — | | | Susan M. Collyns

| | — | | | Richard J. Dahl

| | 47,000 | | | Larry A. Kay

| | — | | | Caroline W. Nahas

| | — | | | Douglas M. Pasquale

| | — | | | Gilbert T. Ray

| | — | | | Lilian C. Tomovich

| | — | | | Stephen P. Joyce

| | — | | | Thomas H. Song

| | 8,263 | | | Jay D. Johns

| | 12,392 | | | John C. Cywinski

| | 79,285 | | | Bryan R. Adel

| | 42,000 | | | All directors and executive officers as a group (15 persons)

| | 191,128 |

(2) | Unvested RSAs are deemed beneficially owned because grantees of unvested RSAs under the Corporation’s equity compensation plans hold the sole right to vote such shares.

2023 PROXY STATEMENT | EXECUTIVE COMPENSATION |

(3) | Includes unvested RSUs for Mr. Berk 2,836; Mr. Brestle 2,836; Mr. Dahl 2,836; Mr. Kay 2,836; Ms. Nahas 1,205; Mr. Pasquale 2,836; and Mr. Ray 2,836. Each RSU represents a contingent right to receive one share of common stock. There are no voting rights associated with RSUs. Directors and certain executive officers also hold RSUs that are not included in the beneficial ownership table because vesting will not occur within 60 days of March 18, 2020. The amounts of RSUs held bynon-employee directors as of December 31, 2019 are provided in the section of this proxy statement entitled “Director Compensation” and the amounts of RSUs held by executive officers are provided in the Outstanding Equity Awards at FiscalYear-End Table.

Compensation Policies, Practices and Risk Management The Compensation Committee, along with the Chief Executive Officer, continually assess the Corporation’s compensation policies and practices to evaluate whether they remain aligned with the Corporation’s pay-for-performance culture, the creation of long-term stockholder value, effective risk management and strong governance practices. The Compensation Committee believes that, through a combination of risk-mitigating features and incentives guided by relevant market practices and corporate-wide goals, our compensation policies and practices do not present risks that are reasonably likely to have a material adverse effect on the Corporation. The Compensation Committee believes that appropriate safeguards are in place with respect to compensation policies and practices that assist in mitigating excessive risk-taking that could harm the value of the Corporation or reward poor judgment by the Corporation’s executives and other employees. The Compensation Committee’s independent compensation consultant, Exequity LLP (“Exequity”), conducted a risk assessment in 2022 of the Corporation’s compensation policies and practices as they apply to all employees, including the NEOs. Exequity reviewed the design features and performance metrics of the Corporation’s cash and stock-based incentive programs along with the approval mechanisms associated with each and determined that the Corporation’s policies and practices were unlikely to create risks that are reasonably likely to have a material adverse effect on the Corporation. The following actions, practices and policies are intended to provide for continued alignment with the Corporation’s principles and/or reduce the likelihood of excessive risk-taking: |

(4) | The amount for Mr. Berk does not include 740,545 shares of the Corporation’s Common Stock beneficially owned by MSD SBI, L.P. MSD Capital, L.P. is the general partner of MSD SBI, L.P. and may be deemed to beneficially own securities owned by MSD SBI, L.P. Mr. Berk is a partner of MSD Capital, L.P. and may be deemed to beneficially own securities owned by MSD Capital, L.P. Mr. Berk disclaims beneficial ownership of the shares that may be deemed to be beneficially owned by MSD Capital, L.P., except to the extent of his pecuniary interest therein.

|

(5) | The amount for Mr. Dahl includes 24,687 shares of Common Stock held by the Richard J. Dahl Revocable Living Trust dated 1/20/1995, of which Mr. Dahl serves as Trustee.

|

(6) | The amount for Mr. Kay includes 12,645 shares of Common Stock held by the IRA Trustee for the benefit of Mr. Kay.

|

(7) | The amount for Mr. Pasquale includes 5,090 shares of Common Stock held by the Pasquale Living Trust.

|

(8) | The amount for Mr. Johns includes 6,952 shares of Common Stock held by the Jay D. Johns Revocable Trust created on 9/20/2013.

|

| | | 20 | |  |

| 2020 PROXY STATEMENT

| EXECUTIVE COMPENSATION

|

EXECUTIVE COMPENSATION

COMPENSATION COMMITTEE REPORT

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) ofRegulation S-K with management. Based on its review and discussion, the Compensation Committee recommended that the Board of Directors include the Compensation Discussion and Analysis in this proxy statement and the Corporation’s annual report onForm 10-K.

THIS REPORT IS SUBMITTED BY THE

COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS

Daniel J. Brestle (Chairman)

Howard M. Berk

Caroline W. Nahas

COMPENSATION DISCUSSION AND ANALYSIS

The following discussion provides an overview and analysis of the Corporation’s compensation programs and policies, the material compensation decisions made under those programs and policies with respect to the Corporation’s named executive officers (the “NEOs”) and the material factors that were considered in making those decisions. Following this Compensation Discussion and Analysis is a series of tables under the heading “Compensation Tables” containing specific data about the compensation earned by or granted to our NEOs in 2019.

The following executive officers were NEOs in 2019:

Chief Executive Officer, Stephen P. Joyce;

Chief Financial Officer, Thomas H. Song;

President of the Applebee’s Business Unit, John C. Cywinski;

President of the IHOP Business Unit, Jay D. Johns, who was promoted to President of the IHOP Business Unit as of June 13, 2019; and

Senior Vice President, Legal, General Counsel and Secretary, Bryan R. Adel

Directors and officers of the Corporation are subject to stock ownership guidelines. | | |  | | 21 |

| 2020 PROXY STATEMENT

| EXECUTIVE COMPENSATION

|

Executive Summary

2019 Fiscal Year Performance Highlightsand Link to Pay Decisions

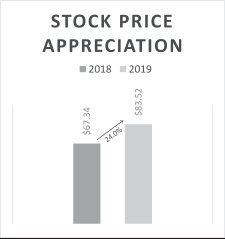

Our compensation decisions for 2019 were driven by our overarching goal of creating long-term stockholder value and linking pay with performance. 2019 performance was defined by several significant achievements but with mixed results in certain key metrics:

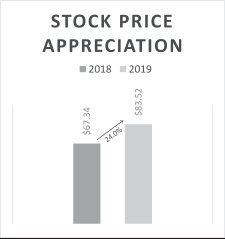

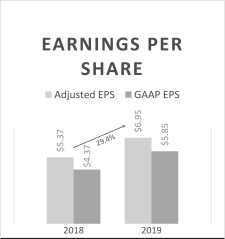

| | | | |  STOCK PRICE APPRECIATION STOCK PRICE APPRECIATION | |  EARNINGS PER SHARE EARNINGS PER SHARE | |  SAME RESTAURANT SALES SAME RESTAURANT SALES | | | | Year over year growth calculated based on the Corporation’s stock price on the last trading day of each period | | AEPS calculated as total adjusted net income available to common stockholders divided by weighted average diluted shares.

AEPS is anon-U.S. GAAP measure. Reconciliation of U.S. GAAP earnings per share to AEPS is provided in Appendix C

| | Percentage change in sales in 2019 compared to the same period of 2018 for domestic restaurants operated during both years and open for at least 18 months |

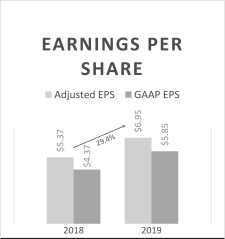

Adjusted Earnings Per Share (AEPS) for fiscal 2019 increased 29.4% year-over-year to $6.95. Similarly, net income available to common stockholders, as reported pursuant to U.S. GAAP (GAAP EPS) increased from $4.37 in 2018 to $5.85 in 2019, a 33.9% year-over-year increase.

The Corporation returned over $156 million to our stockholders, comprised of $109.7 million in the form of stock repurchases and $46.9 million in cash dividends, with cash dividends reflecting a 10% increase in our quarterly dividend to $0.69 per share, effective with the dividend declared in the first quarter 2019.

The Corporation refinanced $1.3 billion of fixed rate senior notes.

Cash flows from operating activities for fiscal 2019 increased 10.6% to $155.2 million.

IHOP signed the largest multi-unit development agreement in its history, calling for the development, with TravelCenters of America, of nearly 100 IHOP restaurants over the next five

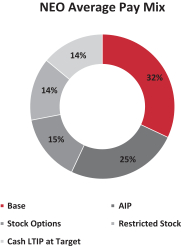

The Corporation’s compensation mix is balanced among fixed components such as salary and benefits, and variable compensation such as annual cash incentive payments and long-term incentive awards, including NQSOs, RSAs, and participation in the cash LTIP, which generally vest or are earned over three years. IHOP operating profit performance exceeded target levels under our 2019 annual cash incentive plan while Dine Brands and Applebee’s operating profit performance fell below target.

IHOP and Applebee’s same-restaurant sales underperformed internal targets and industry benchmarks in 2019; IHOP same-restaurants-sales achieved positive growth for the eighth consecutive quarter.

For fiscal years 2017 through 2019, the Corporation’s Total Shareholder Return was 20.4%, achieving a percentile rank of 54.5% relative to an index of publicly-traded restaurant companies.

| | | 22 | |  |

| 2020 PROXY STATEMENT

| EXECUTIVE COMPENSATION

|

We believe that the Corporation’s 2019 compensation results were commensurate with the Corporation’s performance in 2019, demonstrating a commitment to apay-for-performance philosophy.

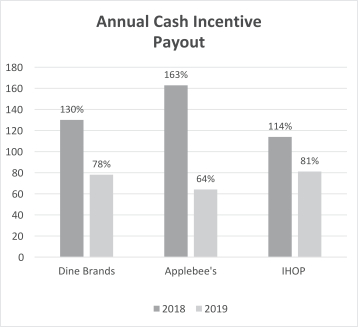

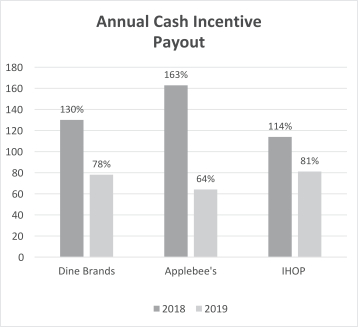

With respect to our NEOs, the Corporation’s 2019 annual cash incentive plan paid out at approximately 78.0% of target for Dine Brands, 63.5% of target for the Applebee’s Business Unit and 80.6% of target for the IHOP Business Unit. The Dine Brands target is applicable to Mr. Joyce, Mr. Song, and Mr. Adel, while the Applebee’s Business Unit target and IHOP Business Unit Target are applicable to Mr. Cywinski and Mr. Johns, respectively.

Annual Cash Incentive Payout Annual Cash Incentive Payout

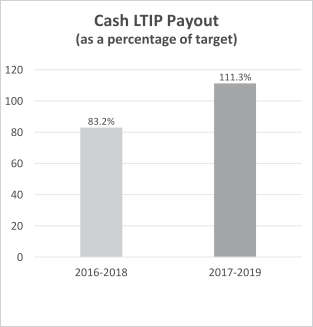

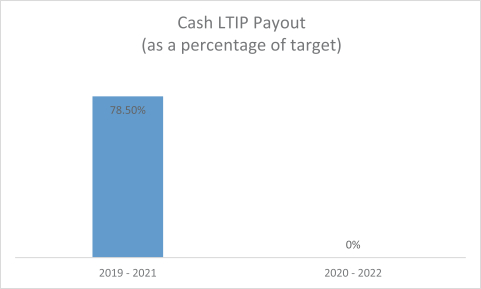

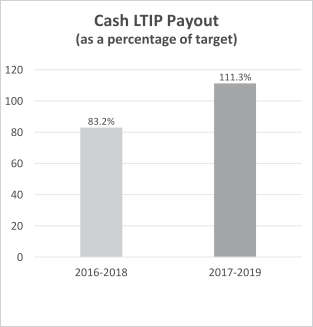

The long-term cash incentive plan for fiscal years 2017 through 2019 paid out at 111.3% of target for 2017 – 2019 due to a relative total stockholder return (“TSR”) percentile rank of 54.5% relative to an index of publicly traded restaurant companies (compared to a percentile rank of 44.3% for 2016 – 2018).

Cash LTIP Payout (as a percentage of target) Cash LTIP Payout (as a percentage of target)

† | For complete information regarding the Corporation’s 2019 performance, stockholders should read “Management’s Discussion and Analysis of Results of Operation and Financial Condition” and the audited consolidated financial statements and accompanying notes thereto contained in the Corporation’s 2019 annual report on Form10-K filed with the SEC on February 24, 2020, which is being made available to stockholders with this proxy statement.

|

| | |  | | 23 |

| 2020 PROXY STATEMENT

| EXECUTIVE COMPENSATION

|

Compensation Policies, Practices and Risk Management

The Compensation Committee, along with the Chief Executive Officer and the Senior Vice President, Chief People Officer, continually assess the Corporation’s compensation policies and practices to evaluate whether they remain aligned with the Corporation’spay-for-performance culture, the creation of long-term stockholder value, effective risk management and strong governance practices.

The Compensation Committee believes that, through a combination of risk-mitigating features and incentives guided by relevant market practices and corporate-wide goals, our compensation policies and practices do not present risks that are reasonably likely to have a material adverse effect on the Corporation. The Compensation Committee believes that appropriate safeguards are in place with respect to compensation policies and practices that assist in mitigating excessive risk-taking that could harm the value of the Corporation or reward poor judgment by the Corporation’s executives and other employees.

The Compensation Committee’s independent compensation consultant, Exequity LLP (“Exequity”), conducted a risk assessment in 2019 of the Corporation’s compensation policies and practices as they apply to all employees, including the NEOs. Exequity reviewed the design features and performance metrics of the Corporation’s cash and stock-based incentive programs along with the approval mechanisms associated with each and determined that the Corporation’s policies and practices were unlikely to create risks that are reasonably likely to have a material adverse effect on the Corporation.

The following actions, practices and policies are intended to provide for continued alignment with the Corporation’s principles and/or reduce the likelihood of excessive risk-taking:

The Compensation Committee reviews Chief Executive Officerpay-for-performance alignment by evaluating the Chief Executive Officer’s compensation relative to the Corporation’s TSR performance over the last five years.

Directors and officers of the Corporation are subject to stock ownership guidelines.

The Corporation’s compensation mix is balanced among fixed components such as salary and benefits, and variable compensation such as annual cash incentive payments and long-term incentive awards including NQSOs, RSAs, RSUs, and participation in the cash long-term incentive plan (“cash LTIP”), which generally vest or are earned over three years.

The Corporation’s annual cash incentive plan and three-year cash LTIP both have capped payment opportunities and primarily reward achievement for different performance metrics. Further, the cash LTIP is measured against an index of publicly-traded restaurant companies and, beginning with the 2018-2020 cycle, a second financial performance metric – average adjusted earnings per share over the performance period.

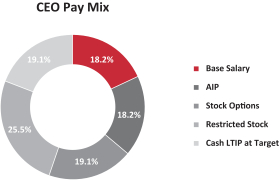

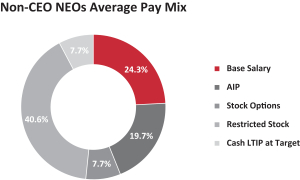

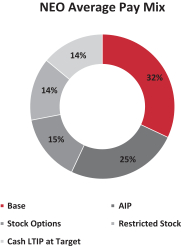

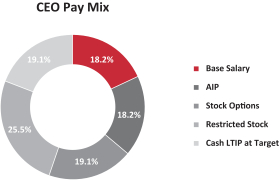

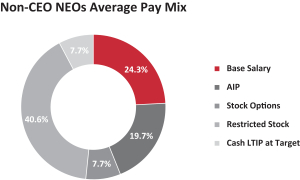

The Corporation’s annual cash incentive plan and three-year cash LTIP both have capped payment opportunities and primarily reward achievement for different performance metrics. Further, performance under the cash LTIP is evaluated in a relative context against an index of restaurant companies traded on U.S.-based exchanges. The Compensation Committee has ultimate authority to determine, and increase or decrease, if appropriate, compensation provided to the Corporation’s executive officers, including each of the NEOs. The Compensation Committee annually undertakes a “tally sheet” analysis of total annual compensation and the total potential payout under various termination scenarios for the NEOs. | • | | The Compensation Committee reviews Chief Executive Officer pay-for-performance alignment by evaluating the Chief Executive Officer’s compensation relative to the Corporation’s TSR performance over the last three years. |

The Corporation maintains a Clawback Policy, which allows the Board of Directors to recoup incentive compensation in certain circumstances. See “Clawback Policy” for further details on the Corporation’s policy. | • | | All outstanding long-term incentive award agreements use a “double-trigger” definition for acceleration of vesting that requires both a change-in-control and a qualifying termination following such change-in-control. |

All employees, including our NEOs, and the Board of Directors are subject to the Corporation’s Insider Trading Policy, which contains a prohibition on engaging in hedging and pledging transactions involving the Corporation’s securities. | • | | The Compensation Committee has set the grant date for annual equity awards to be the close of business on the second full business day after our announcement of fiscalyear-end earnings. The Compensation Committee utilizes the services of an independent compensation consultant who does not provide any other services to the Corporation

|

The Compensation Committee utilizes the services of an independent compensation consultant (who does not provide any other services to the Corporation) and has the authority to retain any advisor it deems necessary or advisable to fulfill its obligations. The Corporation’s equity compensation plans do not permit repricing of previously granted stock options without stockholder approval. | | | 24 | |  |

| 2020 PROXY STATEMENT

| EXECUTIVE COMPENSATION

|

The Corporation has not authorized any multi-year guaranteed bonuses. | • | | The Corporation does not provide tax“gross-ups” on severance payments or perquisites other than certain expenses related to relocation. Overview of Executive Compensation Philosophy and Objectives

The Compensation Committee has structured the Corporation’s executive compensation programs to align with a compensation philosophy that is based on several objectives, including:

Instilling an ownership culture and linking the interests of the NEOs with those of the Corporation’s stockholders;

Rewarding executives for achievement of both annual and longer-term financial and key operating goals of the Corporation; and

Facilitating the attraction, motivation and retention of highly talented, entrepreneurial and creative executive leaders.

The Role of the Compensation Committee

Under its charter, the Compensation Committee has the sole authority to determine and approve compensation for the Corporation’s NEOs and other executive officers. In addition, the Compensation Committee, which is comprised solely of independent directors and reports regularly to the Board of Directors:

reviews and approves compensation and benefits programs including grants made pursuant to the Corporation’s equity compensation plans;

oversees the Corporation’s executive compensation philosophy and strategy;

ensures that proper due diligence, deliberations, and reviews of executive compensation are conducted;

maintains visibility into, assists with the development of, and monitors progress of programs regarding the Corporation’s organizational culture, including diversity and inclusion; and

oversees risks related to the Corporation’s compensation practices.

The Compensation Committee is also responsible for reviewing the compensation for the members of the Board of Directors and submits any recommended changes for approval by the Board of Directors.

The Compensation Committee reviews the Corporation’s executive compensation plans throughout the fiscal year. Decisions concerning annual salary increases, the approval of annual cash incentives, the design and objectives of each year’s incentive plan and the granting of long-term incentive (“LTI”) awards are typically made in the first quarter of each fiscal year after a series of meetings among the Compensation Committee, its compensation consultant, the Chief Executive Officer and the Senior Vice President, Chief People Officer. The Compensation Committee also performs a “tally sheet” analysis which provides the Compensation Committee with information related to total annual compensation of each NEO and the potential payout each NEO would receive upon separation from the Corporation. The Compensation Committee performs this analysis on an annual basis as part of its oversight function with respect to executive compensation.

The general practice of the Compensation Committee has been to evaluate annually the performance of the Chief Executive Officer and the other executive officers and approve compensation based on this evaluation. As it relates to the assessment of the Chief Executive Officer’s performance, the Chairman of the Board of Directors and the chairs of the Compensation Committee and the Nominating and Corporate Governance Committee discuss annual performance goals with the Chief Executive Officer and conduct an annual performance review and compensation discussion.

In addition, the Compensation Committee annually determines the compensation of the other executive officers based on evaluations of their respective performance.

| | |  | | 25 |

| 2020 PROXY STATEMENT

| EXECUTIVE COMPENSATION

|

| | |  | | 25 |

| Generally, the Chief Executive Officer and the Senior Vice President, Chief People Officer provide input to the Compensation Committee in connection with its compensation deliberations except with regard to decisions concerning themselves: